tax benefit rule definition and examples

Tax Advantages For Donor Advised Funds Nptrust. Tax benefit definition.

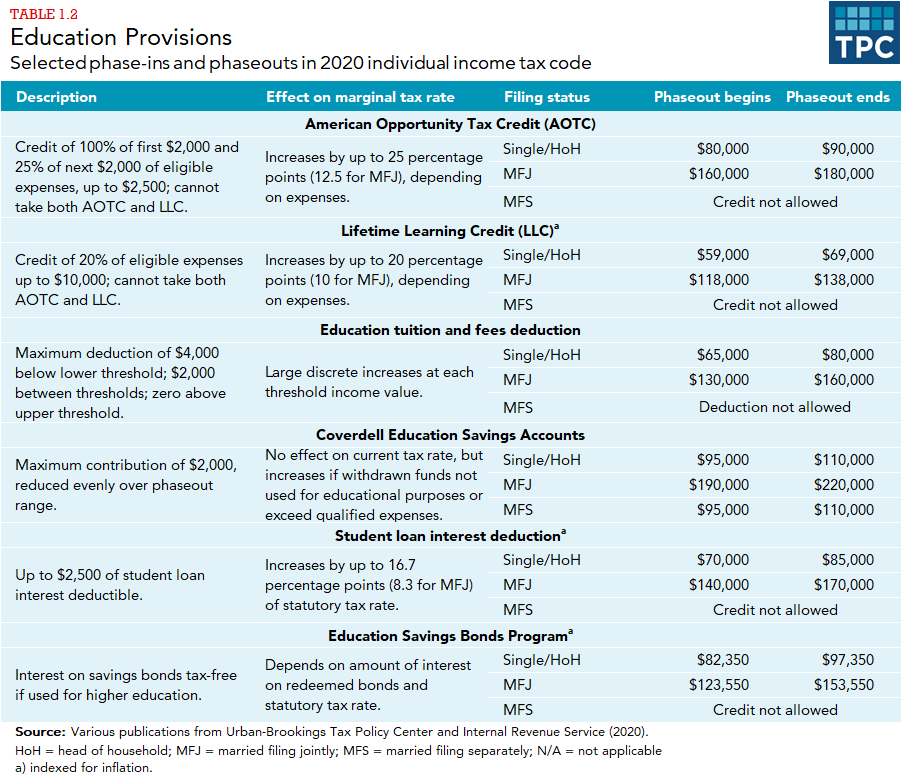

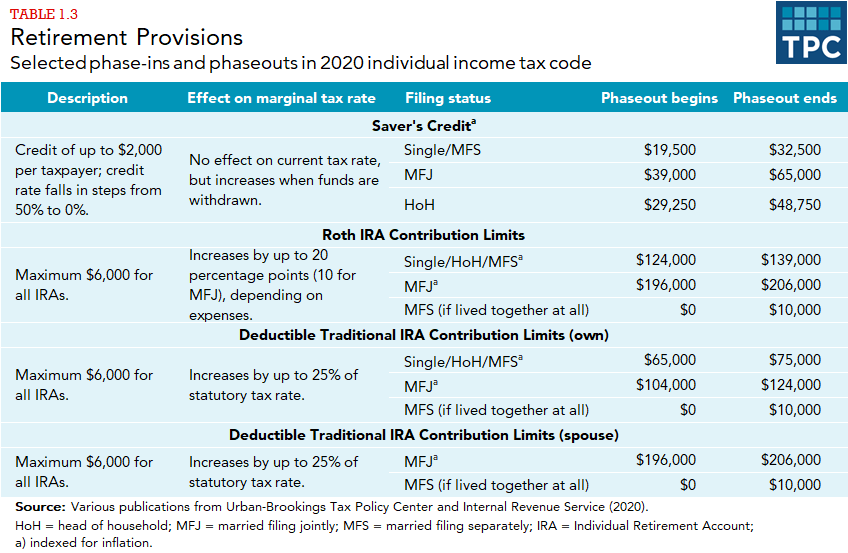

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Does a Tax Benefit Work.

. Type Of Direct Tax Compliances In India Examples Meaning Ascgroup Transfer Pricing Taxact Compliance. A taxpayer used a standard deduction in 2011. If the amount of the loss was not taken as a deduction in the year the loss occurred the recovered amount is not.

The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period. Joe and Denise Smith itemize deductions on their 2018 income tax return. If you were to owe 1500 in taxes but qualify for and claim a 2000 refundable tax credit the IRS would send you a 500 refund for the difference.

Benefits range from deductions and tax credits to exclusions and. Examples of tax benefit tax benefit The baby bonus was abolished and replaced with a family tax benefit equivalent to less than half of the then-current payment. Thus C is required to include.

The term tax benefit refers to any tax law that helps you reduce your tax liability. Examples of tax benefit. Consider a taxpayer who pays 10000 of state income taxes in year 1 and 10000 in year 2 both payments for year 1 taxes.

A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the. Gross income does not include income attributable to the. The tax benefit rule is codified in 26 USC.

Of state income tax in 2018 Cs state and local tax deduction would have been reduced from 10000 to 9500 and as a result Cs itemized deductions would have been reduced from 15000 to 14500 a difference of 500. On Schedule A they listed real estate taxes of 7000 and state income taxes of 7000. Benefits Received Rule.

99514 1812a2 substituted reducing tax imposed by this chapter for reducing income subject to tax or reducing tax imposed by this chapter as the case may be. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a subsequent yearthe money must be counted as income in the subsequent year. However in 2012 the taxpayer receives a state tax refund.

Its also the name of an IRS rule requiring companies to pay taxes on income that was previously written off but is subsequently recovered. Equivalently stated taxpayers must include in income any amounts recovered if they received a tax benefit in a prior year for that loss. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011.

For example lets assume that in 2009 Company XYZ expected to receive 100000 from a. Meaning pronunciation translations and examples. When their 2018 state income tax return was prepared the couple received a.

Joe and Denise Smith itemize deductions on their 2018 income tax return. What is the Tax Benefit Rule. Example of the Tax Benefit Rule.

The benefit of something is the help that you get from it or the advantage that results. C received a tax benefit from 500 of the overpayment of state income tax in 2018. The year 1 deduction for state income taxes is the 10000 paid in year 1.

A less traditional example of a pre-tax deduction allowance is a commuter cash benefit which helps staffers pay for transportation to. 98369 amended section generally substituting provisions relating to recovery of tax benefit items for provisions relating to recovery of bad. The rule is promulgated by the Internal Revenue Service.

Examples Involving Compensation Rul. For example say your tax liability for the year was 1500 but you qualified for a 1000 tax credit. Suffers a fire a few days after completion of a building that cost 500000 to build.

Taxable Income What Is Taxable Income Tax Foundation. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event depend in some degree on the prior related tax treatment. In tax terminology the phrase tax benefit rule refers to whether or not a refund or recovery received in a future year is taxable.

In the revenue ruling a tax exempt hospital entered into a contract with a. Legal Definition of tax benefit rule. The tax benefit is the lessor of the actual deduction claimed or the amount the deduction causes your total itemized deductions to exceed your applicable Standard Deduction amount.

A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden. Thursday March 17 2022. Tax benefit rule definition and examples.

For example if a taxpayer recovers an expense or loss that he previously wrote off against the prior years income then the recovered amount must be included in the current years gross income. On Schedule A they listed real estate taxes of 7000 and state income taxes of 7000. A tax benefit is interpreted.

The key question under this rule is did you receive a tax benefit from taking a deduction for the refund item in a prior. 113 is an example of a possible inurement situation which did not jeopardize an organizations exempt status. For example whether or not a state income tax refund is taxable on your federal return depends on the tax benefit rule.

According to the tax benefit rule - part of the state income tax refund above standard deduction is included into 2012 taxable income. A somewhat more complicated and more common example involves payments of state income taxes in both year 1 and year 2. If you receive.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction. In that case you would owe the IRS only 500. The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Original Issue Discount Bonds Meaning Accounting Benefits And Drawbacks Accounting And Finance Accounting Education Business Entrepreneur Startups

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Turning Losses Into Tax Advantages

Pin By Meli Arellano On Kids Homeschool Math Teaching Quadrilaterals

Fin 48 Compliance Disclosing Tax Positions In An Age Of Uncertainty

Tax Advantages For Donor Advised Funds Nptrust

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

How The Tcja Tax Law Affects Your Personal Finances

Turning Losses Into Tax Advantages

High Academic Professionals Of Essay Bureau Will Help You To Complete Your Essey Writing Get The Benefits Of O Learn English Grammar Comma Rules Grammar Rules

Original Issue Discount Bonds Meaning Accounting Benefits And Drawbacks Accounting And Finance Accounting Education Business Entrepreneur Startups

10 Different Types Of Journal In Accounting Types Of Journals Cash Flow Statement Accounting

Framework For The Preparation And Presentation Of Financial Statements Accounting Taxation Financial Statement Financial Accounting

Bank Statement Balance Sheet Five Benefits Of Bank Statement Balance Sheet That May Change Y Personal Financial Statement Financial Statement Balance Sheet

/TaxBenefit-45ba63a4dbdc40f791f03795102d611f.jpg)